We help project finance advisors train their teams in financial modelling… and students break into the project finance industry

We Arm You With The Training, Tools and Financial Modelling Templates - You

Customize the Models and Close the Deals

2,500 Project Finance Students And Counting...

Powered by

ETEL - Trained Team to Highly Competent Modellers in 1 Month

“As a past M&A advisor and latterly a direct investor (via corporate and project finance), I can safely say that Kyle has been the best trainer I’ve ever seen. He’s been able to take my team, some with little knowledge of financial modelling, to a highly competent level in a short period of time”

Benefits

Reduce model building & re-work time by 30-70%

Get step by step guidance on building a project finance model

Get a head start with a library of tools and templates

Self-study program – build a project finance model step by step with 18+ hours of online content

“This is some of the best training on the market” – Andre Karihaloo

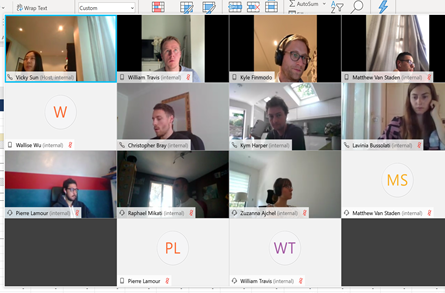

2 livestream classes – join the instructors live to cover customized extension material, get questions answered

“Kyle was one of the best trainers I’ve ever seen” – Jason Frank

“Karina was exceptional…” – XX

Submit homework – get graded feedback on each weeks homework to improve faster

“The homework enabled our team to hone in on exactly where they could improve” – Wallise Wu

Get industry templates – get templates for wind, solar and toll road projects – with more on the way

“The final wind model was exceptional - I adapted the template to use for

evaluating bids for deep sea cable and it got great comments from the

investment committee” – Andre Karihaloo

Project Finance Modelling Sprint

The Project Finance Modeling Sprint is comprised of a 30 day intensive educational experiences, designed for full-time professionals,broken into two stages:

BLUEPRINT FOR PROJECT FINANCE

Pre-learning: Master Excel with Excel DNA – a data backed program for learning formula, tools, and shortcuts to become a bulletproof financial modeller.

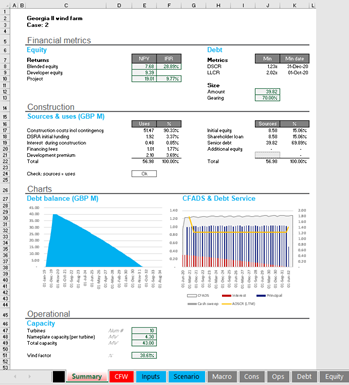

Main learning: Learn essential PF theory, and with a wind-farm case study, build from scratch an infrastructure cashflow model.

- Build from scratch: Timing sheet for flexibility

- Construction, sources & uses

- Operations; revenue, opex & escalations

- Debt: annuity, sculpting, DSCR & LLCR calculations

- Cashflow Waterfall: calculate CFADS in a waterfall

- Equity returns & project returns

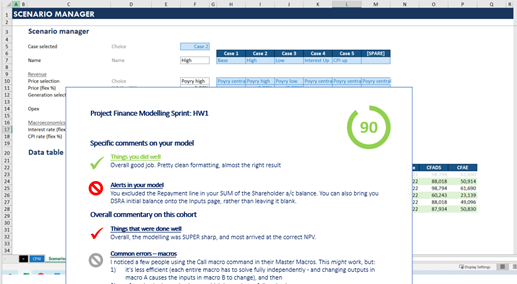

- Scenario manager & data table for sensitivity analysis & optimisations

Learn how to adapt the wind model for solar project finance, and the key changes to make for infrastructure projects.

Learning commitment:

- 4 hours live sessions

- 11 hours self study content

ADVANCED PROJECT FINANCE

Continuing from the Blueprint model, pull together the elements to deliver a bankable financial model.

Learn from world class instructors how to build best practice project finance models, and apply investment committee style scenario analysis to a project finance model.

- Learn the relationship between debt sculpting & debt sizing to a Term Sheet

- Write macros to size debt quickly

- Incorporate a DSRA & discuss a DSRF

- Bring in and discuss refinancings

- Add in a shareholder loan / subordinated debt to the financing structure

- Calculate working capital, corporate tax & depreciation using straight line, reducing balance, or MACRS methodology

- Bring together a P&L & balance a Balance Sheet

- And more in the extensions program

Learning commitment:

- 4 hours live sessions

- 11 hours self study content

What You Get

Meet Your Instructors

Kyle Chaning-Pearce has trained project finance and infrastructure modeling to some of the worlds top PF organisations, including the World Bank, Macquarie Capital and many others. Kyle was the Head of Training EMEA at Mazars Global Infrastructure Finance, formerly Corality Financial Group. Kyle has worked on infrastructure debt & equity advisory mandates and enjoyed a brief stint with a large project finance bank performing credit analysis.

Karina Tam has over 10 years experience in project finance and investment banking. She has held positions with Corality Financial Group, Morgan Stanley, Merrill Lynch and ANZ Investment Bank.

Karina has advised large multinational corporations to small-mid caps on mergers and acquisitions, valuation, capital raisings and financial modelling. Her experience has seen her involved in advisory and modelling assignments globally, executing M&A and project finance transactions across a variety of sectors, including infrastructure, renewables, mining & metals and oil & gas.

Q&A

Why buy from you? What makes you so special? We’ve taken every learning we’ve got from collectively giving over 500 DAYS of training project finance to classroom groups over 8 years and we’ve put them into this training. We know how to communicate complex concepts, and keep a finger on the pulse since we build models and advise on deals alongside training.

Who are you guys anyway? We’re ex-Corality Financial Group and Mazars project finance specialists with a background in training –and deeply involved with building models day to day and advising on deals.

What happens if I wait? Our courses fill up fast. Because of the high degree of instructor involvement, our courses are capped to ensure we hit our customers learning outcomes.

What exactly am I signing up for? A 2 week Sprint where you’ll be part of a cohort building a project finance model. You’ll be supported by 2 livestream coaching calls, video lectures, a dedicated Slack channel and frequent check-ins and homework submissions. You’ll get industry specific project finance templates of a wind farm model, a solar farm model and a toll road.

What results will I actually get from this? In short, you’ll understand how a project finance deal fits together and feel confident that you have the skills and tools to build a bankable project finance model yourself.

What evidence do you have to back up these promises and claims? We have trained over 2,500 students collectively, and have raving testimonials to back it up.

What are the two different courses? You will learn best practice project finance modeling and be able to model the cashflow elements of a project finance deal. In the Advanced Project Finance training you’ll get practice building in the advanced debt & equity elements and the tax & depreciation elements, and actually optimise a deal.

What if I don’t have much experience in Excel? The Project Finance Blueprint Sprint has you covered – the Excel DNA will get you up to speed very quickly and comfortable with financial modelling in Excel.

Can you really build bankable models off this training? Yes, absolutely. Almost all of the models we build are scrutinised by banks, and

many companies raise financing using these models as the base and customising for each deal from there. We are here to help, with post-course email support included, or as model builders and auditors, we can discuss a more formal consulting arrangement.

How does the homework section work? Each week, you’ll build a portion of the model, guided by the self study sessions. Submit your completed models to the instructors for review and feedback, and if you want it, grading.

What is included in the 2 livestream sessions? We’ll address specific questions over the self-study material, and we’ll cover extension material that has been voted on during the quiz.

What else can I expect? We’ll send you a quiz to understand what specifically you want to gain from this course

What support can I expect? Aside from the homework and the live calls, you drop a question on the Slack discussion group, or email our instructors anytime.

What are the templates? They’re financial models across different industries – wind, solar and toll roads. They’re fully built out models, intended to be used as resources when you’re building your next model.

Is this a renewables specific training? While the case study follows a wind farm, we discuss how this changes with other industries, and training modules discuss the landscape of project finance deals and PPPs.

Does this cover tax-equity? No, this course doesn’t cover any tax-equity components.

How do I access the online training course? You’ll be given a login to our learning management platform, powered by Finmodo. You can watch each video at your own leisure.

What happens if I don’t like the training? If you aren’t satisfied with the training after the first live session, you can simply email us and get your money back.